Para aquellos en cuarentena solos, la falta de contacto humano puede sentirse agonizante. Un fenómeno neurológico llamado “hambre de la piel” explica por qué.

Sirin Kale, Wired UK 05.05.2020 10:00 AM

Esta historia apareció originalmente en WIRED UK.

Aparte de los abrazos de Lucy, Alice no ha sido tocada por otra persona desde el 15 de marzo, que es cuando entró en un encierro autoimpuesto, una semana antes del consejo oficial del gobierno para aislarse. “Me ha resultado muy difícil”, dice ella. “Soy una persona abrazada. Empiezas a notarlo después de un rato. Lo extraño.” Se siente culpable por sus abrazos subrepticios. “Siento que no puedo contarles a mis otros amigos al respecto”, dice Alice. “Hay mucha vergüenza pasando. Sé que no estamos destinados a hacerlo. Pero estoy muy agradecida con ella por verme. Me da un gran impulso “.

Alice está experimentando el fenómeno neurológico del “hambre de la piel”, sobrealimentado por la pandemia de coronavirus. El hambre de la piel es la necesidad biológica del toque humano. Es por eso que los bebés en unidades de cuidados intensivos neonatales se colocan en el pecho desnudo de sus padres. Es la razón por la cual los prisioneros en confinamiento solitario a menudo informan que anhelan el contacto humano con tanta ferocidad como desean su libertad.

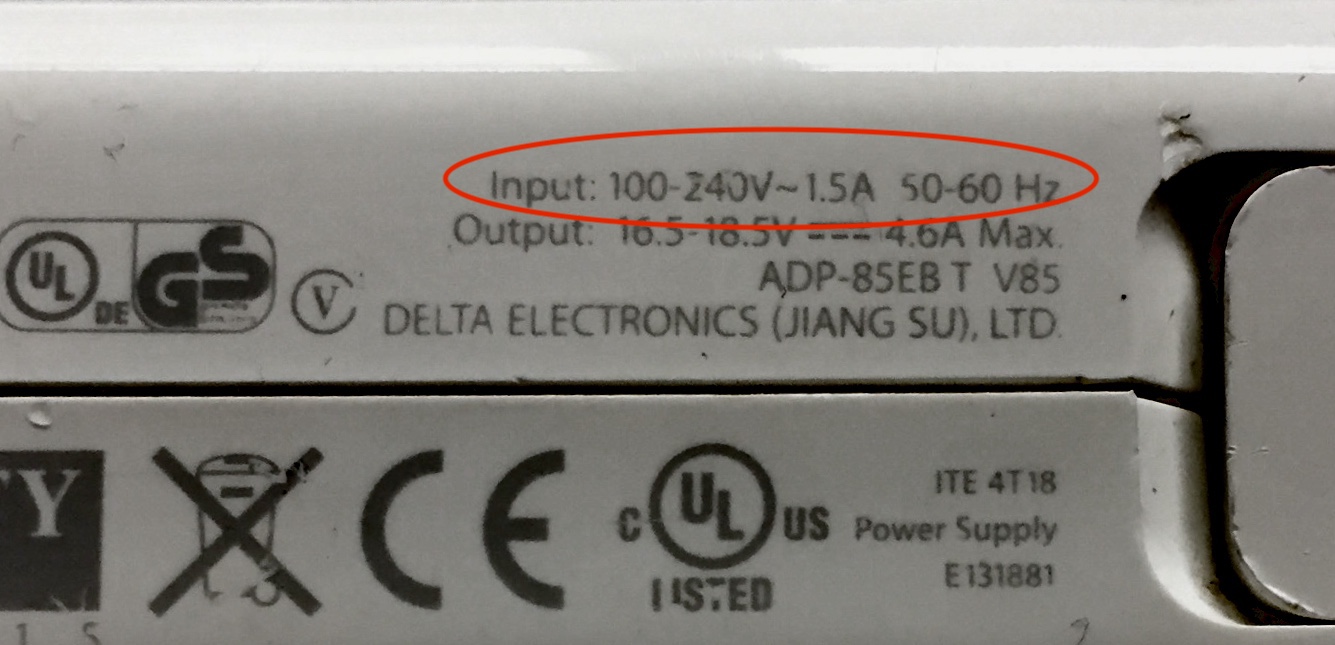

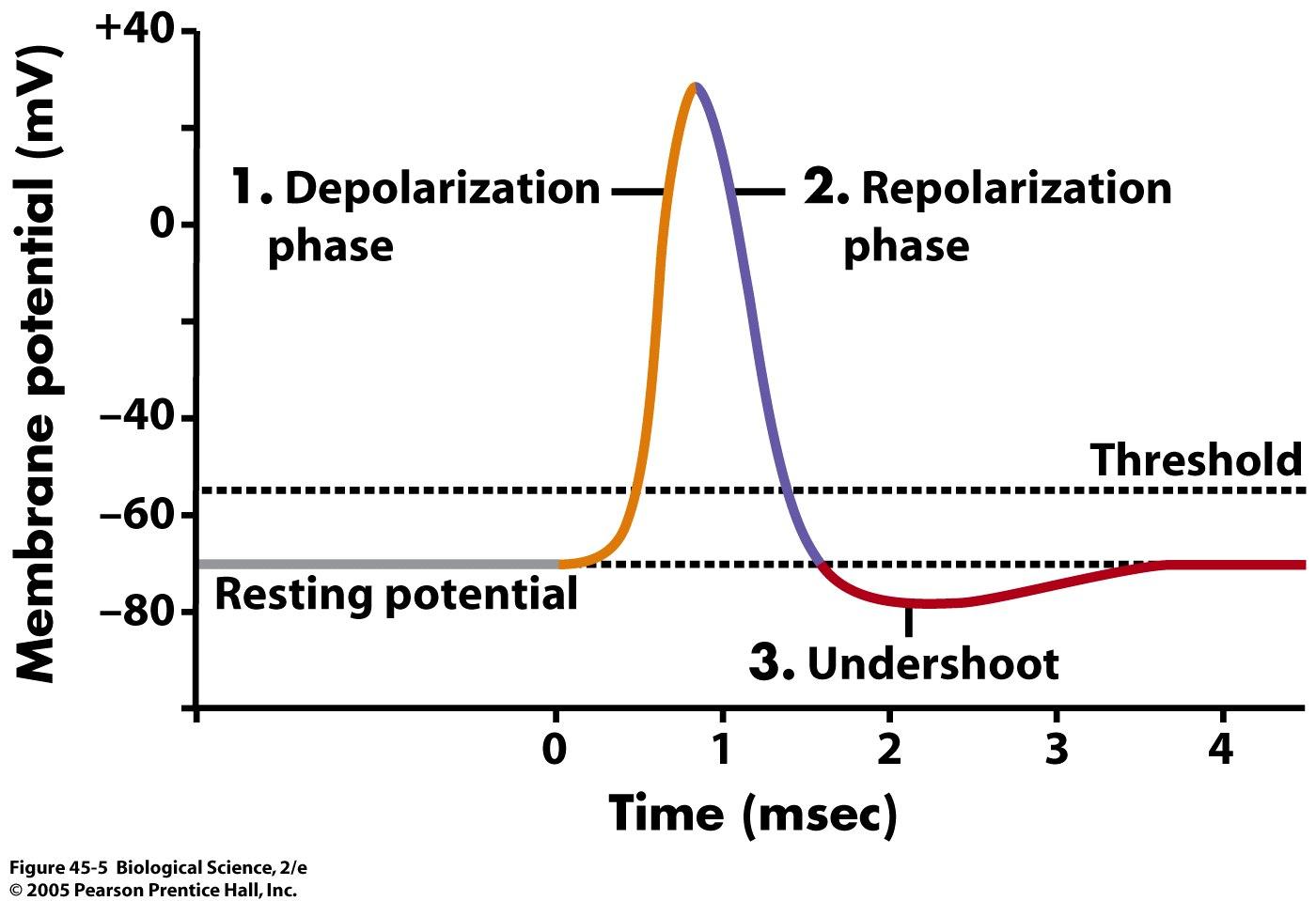

“Cuando tocas la piel”, explica Tiffany Field del Touch Research Institute de la Universidad de Miami, “estimula los sensores de presión debajo de la piel que envían mensajes al vago [un nervio en el cerebro]. A medida que aumenta la actividad vagal, el sistema nervioso se ralentiza, la frecuencia cardíaca y la presión arterial disminuyen, y las ondas cerebrales muestran relajación. Los niveles de hormonas del estrés, como el cortisol, también disminuyen “. Touch también libera oxitocina, la hormona liberada durante el sexo y el parto para unirnos. En otras palabras, el toque humano es biológicamente bueno para ti. Ser tocado hace que los humanos se sientan más tranquilos, más felices y más cuerdos.

Sin contacto, los humanos se deterioran física y emocionalmente. “Sabemos por la literatura que la falta de contacto produce consecuencias muy negativas para nuestro bienestar”, dice Alberto Gallace, neurocientífico de la Universidad de Milano-Bicocca. Explica que los humanos son criaturas inherentemente sociales; Los estudios han demostrado que privar a los monos del contacto físico conduce a resultados adversos para la salud. Nuestros cerebros y sistemas nerviosos están diseñados para hacer del tacto una experiencia agradable, dice. “La naturaleza diseñó esta modalidad sensorial para aumentar nuestros sentimientos de bienestar en entornos sociales. Solo está presente en los animales sociales que necesitan estar juntos para optimizar sus posibilidades de supervivencia “.

Antes de la pandemia de coronavirus, muchas naciones desarrolladas ya corrían el riesgo de convertirse en zonas libres de contacto, con políticas de no contacto ahora comunes en las escuelas e instituciones públicas, por razones de salvaguardia y litigios. El Touch Research Institute de Field ha estado trabajando en un estudio aeroportuario global para observar la cantidad de personas que se tocan entre sí mientras esperan abordar los vuelos. (La investigación se encuentra actualmente en pausa). “Observamos más de 4,000 interacciones”, dice Field. “Los datos mostraron que, al menos en público, prácticamente no hay contacto; el 98 por ciento de las veces, las personas usan teléfonos celulares”.

Con protocolos de distanciamiento social en países de todo el mundo, aquellos que viven solos se encuentran soportando meses sin contacto humano. Esta es una ironía particularmente cruel, dado que el hambre de la piel en realidad debilita nuestro sistema inmunológico, haciéndonos potencialmente más susceptibles al coronavirus. “Estoy muy preocupado”, dice Field, “porque este es realmente el momento en que más necesitamos contacto humano”. Ella explica que el tacto es instrumental en la función inmune porque reduce nuestros niveles de cortisol. Cuando los niveles de cortisol son altos, nuestro sistema inmunitario se agota: el cortisol mata las células asesinas naturales, un tipo de glóbulo blanco que ataca los virus por nosotros. Field dice que se ha demostrado que el contacto humano aumenta las células asesinas naturales en pacientes con VIH y cáncer.

Gallace está profundamente preocupado por las implicaciones para la salud mental del hambre prolongada de la piel para aquellos encerrados solos, particularmente dado que una pandemia global es en sí misma una situación estresante y que provoca ansiedad. “Utilizamos el tacto para la comodidad”, dice. “Cuando estamos en peligro o ansiedad, ser tocado es una forma de ayuda. La falta de contacto aumenta el estrés de las situaciones “. Explica que los estudios han demostrado que las personas realizan mejor las tareas cuando se les da una palmada en la espalda de antemano. “Es una forma de tranquilidad que se remonta al contacto del cuidador cuando eras un niño”, dice.

El equipo de Field ha estado realizando investigaciones durante el cierre: el 26 por ciento de las 100 personas encuestadas les dijo que se sentían muy privados de contacto, y el 16 por ciento moderadamente. De la muestra, el 97 por ciento también informó trastornos del sueño. “Cuando mueve la piel aumenta la serotonina”, explica Field. La baja serotonina se ha relacionado con insomnio, ansiedad y depresión. “Si mueve la piel antes de acostarse, tendrá un sueño más profundo, lo cual es crítico, porque la sustancia P se emite durante el sueño profundo”. (La sustancia P es un neurotransmisor que afecta la percepción del dolor, el estrés y nuestras respuestas emocionales).

Al igual que con tantas cosas en la vida, no nos damos cuenta de cuánto dependemos del contacto humano hasta que ya no podemos tenerlo. “Normalmente soy feliz viviendo sola”, dice Sarah, una profesional de recursos humanos de 40 años de Reading. “Me encanta tener mi propio espacio”. Encontré a Sarah después de encontrar sus publicaciones cada vez más tristes en las redes sociales. El 23 de marzo, Sarah escribió en Facebook: “Voy a abrazarlos a todos tan fuerte cuando se levanten las restricciones. INTENTARÉ no reventarte, pero no prometo nada. El 12 de abril, agregó, “ABRAZOS PARA TODOS CUANDO ESTO HA TERMINADO”. Unos días después, una nota más quejumbrosa. “He estado súper llorosa hoy”, escribió en Twitter el 18 de marzo. “Vivo sola y la idea de no darle un abrazo a nadie por MESES es desesperada”.

Para Sarah, su hambre de piel inducida por el coronavirus se ha sentido como pena. “Me siento desconsolada”, dice ella. “Estoy realmente emocionado. Me siento triste y estresado y bastante deprimido por eso ”. Puede recordar la fecha exacta en que alguien la tocó por última vez: 15 de marzo. Un amigo se había quedado con ella y la abrazó cuando se iba. Aparte de ese abrazo, Sarah no ha tocado a otro ser vivo aparte del gato de su vecino, que ocasionalmente se arrastra a su jardín y le permite acariciarlo, y a algunos gansos que alimentó en un parque cercano. Alice se encontró recogiendo a su gato mascota mucho más de lo habitual. “Normalmente no siento la necesidad de recoger al gato, porque ella lo odia”, dice Alice. “Pero ahora la levanto y le doy un apretón”.

Al acariciar a los animales, Sarah y Alice se han topado inadvertidamente con una estrategia efectiva para mitigar el hambre de la piel. “Sabemos por nuestra investigación que el masajeador se beneficia tanto del masaje como del masajeador”, dice Field. “Entonces tener mascotas es maravilloso. Cuando acaricias a un perro, también mueves tu propia piel y experimentas estimulación por presión “.

Se ha aprovechado mucho el poder de la tecnología para conectarnos durante la pandemia. Pero la tecnología no puede sustituir el contacto piel con piel. “Podemos mantener nuestras relaciones sociales a través de la tecnología”, dice Gallace. “Pero aunque nuestra tecnología es muy avanzada en términos de representación visual y de audio, todas estas tecnologías carecen del sentido del tacto. Básicamente, actualmente no hay sistemas disponibles que nos permitan interactuar usando el tacto ”. Explica que la tecnología háptica, comúnmente utilizada en los juguetes sexuales para imitar la sensación y con los videojuegos, no es lo suficientemente avanzada como para reproducir el vigor y la sutileza de, por ejemplo, un apretón de manos.

“No es fácil simular un apretón de manos”, dice. “La modalidad sensorial involucra muchos sistemas. No son solo los receptores de la piel, sino también la fuerza del apretón de manos. No puedes reproducirlo tan fácilmente. Existen sistemas que reproducen fuerzas similares, pero no están muy extendidos y la calidad de la sensación producida es baja. Hasta ahora, no hay nada que nos permita reproducir una caricia ”.

Pero existen estrategias para reducir el hambre de la piel solo para aquellos que se autoaislan. “Haga todo el ejercicio que pueda”, dice Field. “Simplemente caminar por su habitación estimula los receptores de presión en sus pies. Date un masaje en el cuero cabelludo o frótate la crema hidratante en la cara. Todas estas son formas diferentes en que las personas pueden mover su piel “.

Aún así, hay tantas clases de yoga Zoom que puedes hacer para pasar el tiempo. En algún momento, debe inclinarse hacia el hambre de la piel y aceptar que probablemente viviremos en una sociedad sin contacto hasta que tengamos una vacuna contra el coronavirus. Y tal vez incluso después de eso: después de tanto tiempo tratándonos unos a otros como parias, ¿volveremos realmente a cómo eran las cosas antes? Field teme que el coronavirus nos empuje aún más a una sociedad sin contacto a largo plazo. “Sospecho que cuando esto termine, mucha gente seguirá manteniendo el distanciamiento social”, dice ella. Alice estaba en un supermercado recientemente cuando alguien la pasó rozando: el contacto inesperado la hizo saltar.

Alice se ha sintonizado con sus compañeros de bloqueo solitarios hambrientos de piel: puede sentir su ansia de contacto humano tan intensamente como puede sentir la suya. En una caminata reciente, comenzó a hablar con una mujer mayor que estaba sola en su jardín delantero. Alice sintió que había estado parada allí por un tiempo, buscando a alguien, a cualquiera, con quien hablar. Después de conversar un rato, la mujer extendió la mano. “Ella dijo:” Ven aquí, cariño “e intentó darme un apretón de manos”, recuerda Alice. Alice la miró con empatía.

— Le dije: “Lo siento mucho, pero realmente no puedo .”

Al alejarse, Alice se sintió horrible por rechazar ese anhelo por el toque humano, por un simple apretón de manos. “Me sentí muy mal”, dice Alice. “Porque sabía por qué lo quería. Yo también lo quería “.

*Algunos nombres han sido cambiados.

Esta historia apareció originalmente en WIRED UK.