When Touch ID was announced at the iPhone 5s launch, it was immediately besieged by detractors.

One area in particular for detractors is that the Touch ID system is susceptible is via spoofing an owner’s fingerprint. If true, this would pretty much leave the whole system open to an attacker, and now, with the iPhone 6 and Apple Pay, spoofing would easily expose the owner to fraudulent charges placed on the his credit cards.

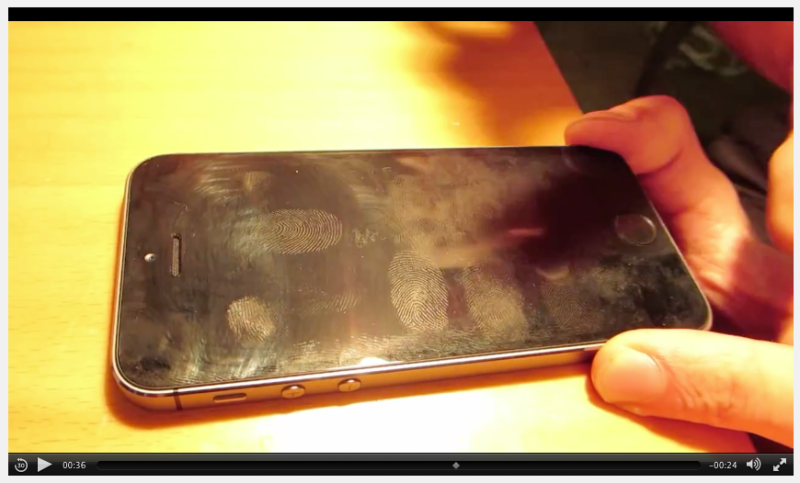

The most convincing exposition on this was by the German Chaos Club group which quickly posted online video of how to spoof the Touch ID sensor system.

With the advent of Apple Pay based on Touch ID, this issue becomes even more critical.

Two facts are clear:

- it works,

- it is not all that difficult.

However, there is one clarification to point #2. It ought to read: